The man at the helm of perhaps the most ubiquitous audio brand in India sits us down for a snapshot on the state of the business. JBL and Harman Kardon are in good hands, as we find out from Vikram Kher, Vice President, Lifestyle, Harman India.

Tech Talk: Vikram Kher, Vice President of Harman India

Speaking about speakers

What is the split between online and offline retail for Harman (India)? Historically, we have been successful via the online model, which makes up for about 45% of our total sales. But also, in a country with such a large number of shoppers beyond the 150 million online, there is a need for our presence offline too. Both, the online and offline channels for us hold equal significance and will continue to coexist.

Being under the Samsung umbrella, how do you harness the massive footprint? We have harnessed the synergy with our parent company (Samsung) in innovative ways. The best example of the two brands working in unison is the Samsung Opera House in Bengaluru. It is one of our largest selling counters for premium luxury products and Harman has its own dedicated section on the ground floor. Another example of close integration is partnering with Samsung gaming monitors to showcase the JBL Quantum range of gaming headphones. This gives gamers a chance to explore JBL gaming products at the SOH.

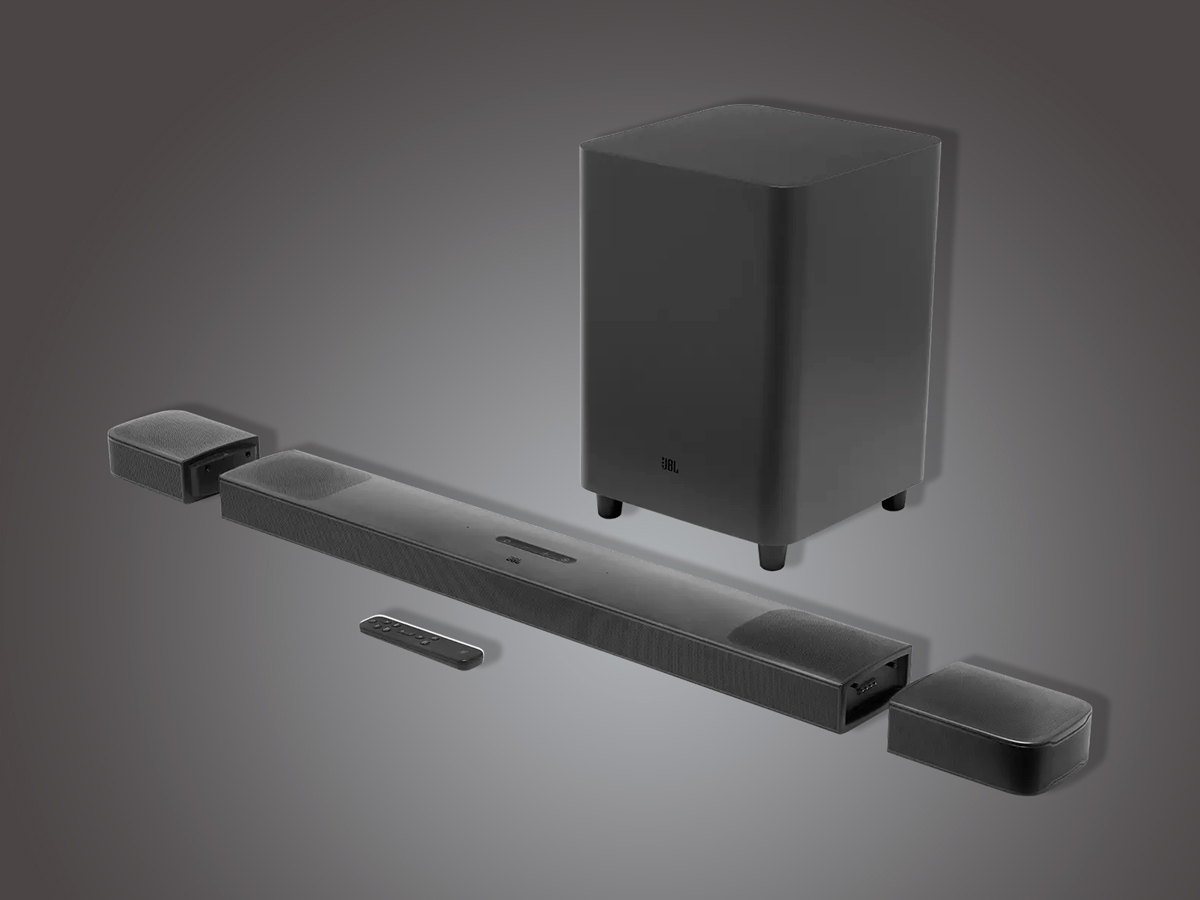

Considering the breadth of your portfolio, what categories are seeing an upward tick? We are undisputed leaders in the speaker category for sure. Our recent launches have been in the soundbar and party box categories. Globally, we have been doing phenomenally well in the party box segment, to the tune of 3.5 million units last year! We have invested heavily in launching new SKUs regularly and refreshing them practically every 12-14 months. The growth is being fuelled by tier 2 and tier 3 markets opening up in the last year and a half. Contrary to our doubts, surprisingly, the JBL Tour One and Bar 9.1 have been some of the best-selling products for us last year and both of these are priced at the premium end.

Do you feel the pressure with JBL to compete with new market entrants? In the TWS category, we’re very sure that as a JBL product, it has to serve its purpose with superior design and functionality. So the recent launches such as the 130NC and 230NC have done great numbers. But, we are not in the business of commoditizing the TWS category or want to devalue our brand.

What is the product or category that looks the most promising for 2022? In the speaker space, the Flip series and the Go series have become iconic. The TWS segment is growing exponentially. Our theme is ‘Mute the World’ and in that vein, even our noise-cancelling headphones like the 660NC and the 760NC have done extremely well. TuneFlex is a new SKU which is the world’s first transformable TWS. So it has a regular earbud form factor when you want openness and spatial awareness, but also comes with silicon tips for a better seal and eliminating any distractions.

Is it safe to assume that the supply chain and availability issues are sorted now? The semiconductor issue affected the Dolby Atmos soundbar business the most, but it has eased out to a large extent now. India being a priority market for Harman, we are also getting all the support we need from the global team. So soundbar availability challenges which we were facing last year are no more there.

What is the pecking order for the Harman brands in India? As far as the Harman Kardon brand is concerned, we have experimented with headphones and TWS categories in the past, but we are now primarily focusing on speakers and Citation sort of products. Multimedia speakers like Onyx and Aura see huge requests from our dealers. In the consumer space, we are predominantly focusing on JBL, Infinity and then Harman Kardon, in that order since this is how they stack up in the revenue pie too.

Will we see any expansion of Harman brands into high-street retail? Reliance Digital’s new experience centre in South Ex, Delhi has an exclusive Harman area that also showcases our luxury brands like Revel and Arcam. So large format retail stores are still central to our brands as they are physical touch points to experience our expertise.

.jpg&w=35&h=35&q=70&c=1)